The future already started in 2020

Since 2020, electricity prices have been much more volatile. This is because intermittent power generation is now a significant part of the European and Nordic electricity system. The increasing volatility of electricity prices opens up new business opportunities. Those who actively manage their exposures create major advantages compared to those who are passive. If handled correctly, flexible consumption, production and storage can bring major benefits to both the operator and the system.

In the SE3 Stockholm electricity price area, a clear change in profile has begun to emerge. The change involves increased price variations over the day. The trend continued both during the low-price year 2020 and during the most acute energy crisis to date in 2022, with spot electricity prices of 21 and 129 EUR/MWh respectively.

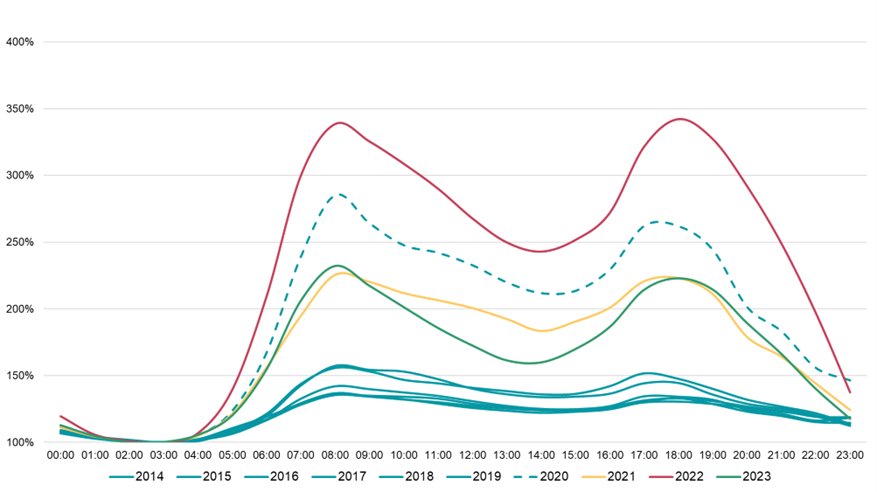

Percentage price compared to the lowest price of the day SE3

Caption: The diurnal variation between 2014 and 2019 was lower than 160%. But since 2020, there are profiles of between 200% and 340%. The peaks in consumption in the morning and evening have a clear impact.

Base load matches worse

On Nasdaq Commodities, futures contracts for future delivery are traded by electricity market participants to hedge price and volume risks. The contracts are standardized and the most common delivery is baseload where each hour is worth the same amount. However, as the underlying electricity spot price has changed, the matching of baseload supply has deteriorated. In the past, the electricity trader could buy a forward contract and add a profile deviation of 50% to cover hourly variations, now up to 250% is needed. This is one of the reasons why residential consumers now have to pay more for fixed price contracts as the electricity trader has to take into account that household consumption takes place during the day including during morning and evening peaks.

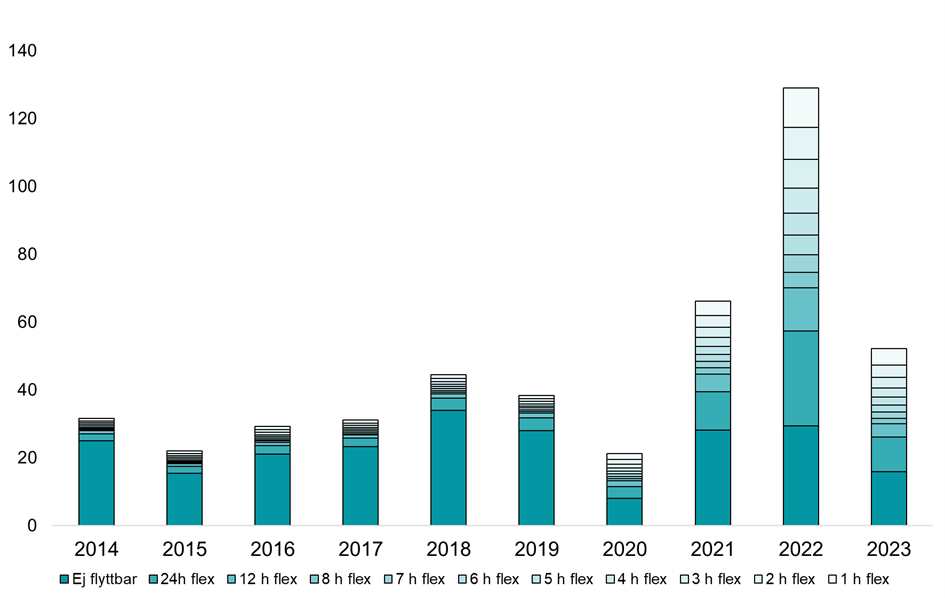

Volatile electricity prices call for new business

A volatile electricity price does not necessarily mean a high electricity price. As the graph below shows, the average price in 2023 was only marginally above the average price in 2018. However, the electricity price in 2023 varied significantly more, both from one month to another and within the day. This means that for a passive actor with inflexible consumption, the price difference between 2023 and 2018 was small. For an actor with daytime, morning and evening consumption, the price was higher in 2023. But for a flexible customer who moved his exposure, the electricity price was significantly lower in 2023.

Electricity price in SE3 depending on flexibility (EUR/MWh)

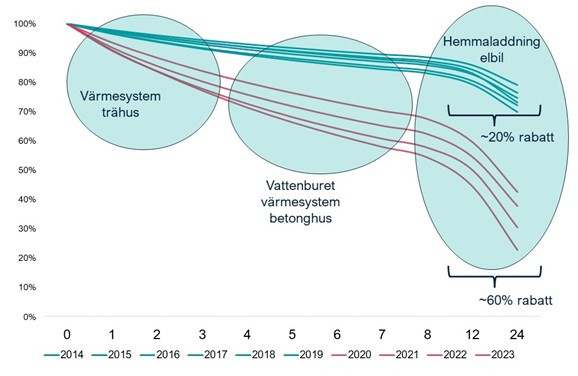

Caption: In recent years, the value of being flexible has increased. Since 2020, an increasing share of the total price depends on the profile. The ability to move your exposure by a few hours has a big impact on the price.

Spot price control matters for consumers

Not all electricity use can or should be flexible. However, there is a lot of electricity use today that, if managed more effectively, could reduce the average cost. Modern technology and connected devices that react to price signals can make a big difference, both for your wallet and for the system as a whole.

Caption: The heating system and car charging are two loads that can be moved in time with relative ease. For the heating system, it matters how much inertia the system has, the higher the heat capacity and less heat leakage in the house, the more flexible the heating is. However, the greatest percentage gain is in the first few hours and even an uninsulated wooden house can benefit from spot price control.

Should electricity networks be for or against their customers?

Flexible consumers can be a major burden or a major asset for electricity network operators, depending on how they respond to the change. In grids with an intraday tariff and power tariff based on the maximum power for a few hours per month, flexible customers can become a problem. With a growing share of flexible customers optimizing against the combination of network tariff and spot market, the tariff can overthrow the network, if the tariff does not match the electricity price and is designed according to the physical needs of the network. On the other hand, an electricity network operator that proactively creates the conditions for customer flexibility frees up a lot of resources because the flexible customers can reduce costs and investments. This increases the competitiveness of the electricity network.

For Sweden out of time, the state's outdated energy tax

The energy tax, which was increased to 53.5 öre/kWh including VAT in 2024, is a formidable obstacle to a functioning electricity market. It effectively erases customers' incentives to respond to the needs of the energy system. In 2023, the electricity spot price was negative for around 400 hours in all of Sweden's electricity price areas. This means that there is no outlet on the energy market for all the electricity produced. But the price signal to consume more is not getting through to customers because the electricity price after tax is still mostly a cost. This has also been observed by the government's own investigator John Hassler, who calls it socio-economically harmful. All actors in the energy system are losing out because the energy tax is so high and so clumsily designed. If it were removed or reformed into a relative tax, more price signals would reach those who can do something with them and open up for systemic business models and solutions.

What we offer:

Sigholm performs analyses, long-term forecasts and clarifies insights that are essential in your organization's navigation in the system transition. The world is changing and through lectures, workshops and longer assignments, we help our customers acquire the skills needed to succeed. If you would like more information about our services, please contact us using the contact details on this page.

- #energi

- #analys

- #analysutskick

The article was published 22/04 - 2024