Sigholm is continuously quantifying and analysing the rapid changes taking place in Europe's energy system.

In our recent long-term forecast, we have weighed up several different aspects and simulated the electricity price for the years 2023-2050 per electricity trading area and per power type. Below is a selection of our conclusions.

Wet, windy and record-breakingly cheap

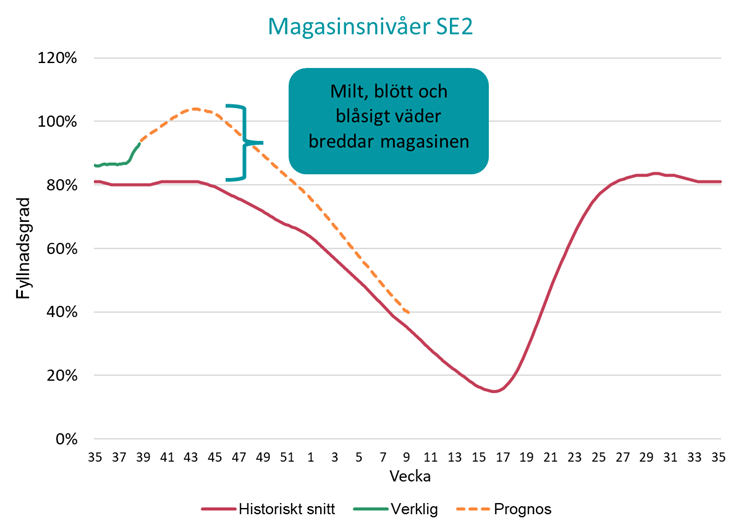

Low pressure has dominated the weather since early July. Mild weather reduces the heat load while wind and precipitation increase production. Especially in Sweden, the reservoirs of hydroelectric power plants are expanded and hydroelectric operators are forced to produce. This is putting considerable pressure on the price, and in week 38 the spot price on NordPool averaged 3.10 öre/kWh in SE3, a historically lowest weekly average for the price area. Out in Europe, the situation is different, and with the gas crisis and robust emission rights prices, electricity prices are around 120 öre/kWh. As soon as hydropower producers in Sweden regain control of the volumes, prices in southern Sweden will quickly rise.

Figure 1: Hydropower plant reservoir levels rise rapidly after months of low heat load, windy weather and abundant precipitation. Especially in SE2 Sundsvall. An average filling rate above 100 % is not possible. Hydropower producers have to choose between producing at low prices now or spilling for free later.

High supply uncertainty

Last winter, the outcome of the energy crisis was not as bad as feared. The heat load shrank in the mild weather, gas stocks lasted better than expected and the availability of liquefied fossil gas (LNG) was unexpectedly good. But the consequences of the loss of Russian gas imports go much further than that. Europe's shift from piped gas supplies under long-term contracts to spot purchases of ship-borne LNG in global competition has resulted in a substantial overall increase in risk across the energy system. In global fuel markets, China is the largest player, accounting for 33% of LNG contracts. It is fortunate for Europe that China's economy is sufficiently robust to allow it to refrain from shipping to us. When the gas storage withdrawal season starts in October, we will roll the dice again. If the winter gets cold or China's economic stimulus bites, the price of gas can rise quickly, dragging the whole fuel complex of coal, emission allowances, biomass and electricity prices up with it. The risks of biomass as a fuel have been revealed this year, with volumes difficult to secure and prices more than doubling.

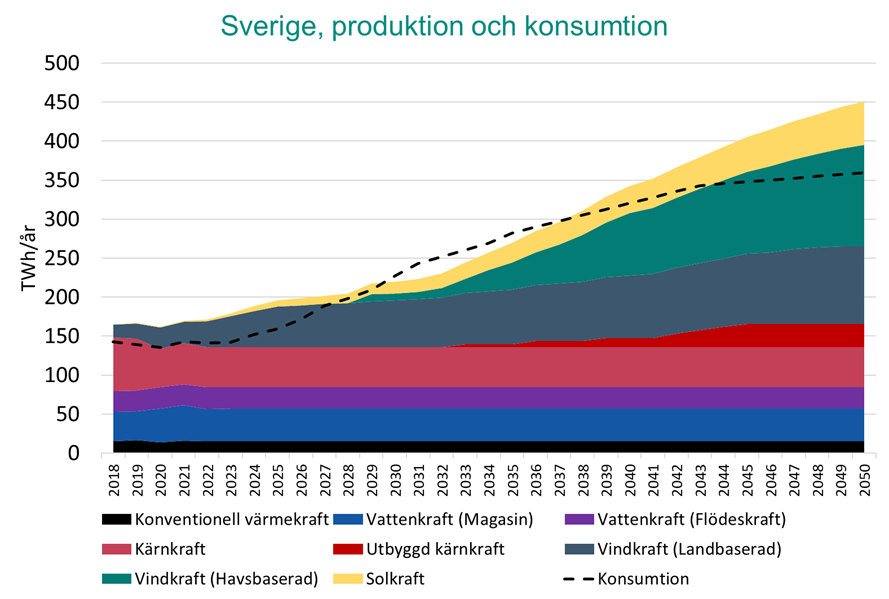

The load is increasing rapidly

Northern Sweden has a power surplus and some of the lowest electricity prices in the EU, but industry's electrification plans will soon remedy this. The connection of new power consumption is happening much faster than for new power generation. The decreasing power surplus leads to a higher degree of price coupling with neighbouring and more costly electricity price areas. By studying in detail reports from 14 actors on the energy situation now and in the future, Sigholm has compiled a picture of developments in the Swedish energy system. From this, several important conclusions can be drawn about power flows and price patterns.

Figure 2: Scenario of production and consumption changes in Sweden until 2050. The underlying data is the aggregated picture from 14 industry actors. Several of the reports differ significantly from each other but the common and critical conclusions provide a good basis for your energy strategy navigation.

Robust carbon prices

Unlike coal and gas prices, the fall in the carbon price has been much more modest. Since falling from €100/tonne, the carbon price has averaged €85/tonne, a level that adds €30/MWh to the marginal costs of gas power and €70/MWh to the marginal costs of coal power. This permanently closes the door to the low electricity prices that prevailed from 2012 to 2019. In line with the Fit-for-55 package from last winter, the cost of emissions also covers a larger number of actors as the system is expanded and free allowances are phased out in favour of carbon-based allowance management (CBAM).

Market liquidity continues to fall

Liquidity on Nasdaq continues its collapse. In the period January to July 2023, only 208 TWh were traded, a record low. The shallow trading erodes the role of the futures market as a representative reference for the price of electricity in future delivery. It complicates asset valuation, budgeting, portfolio management and investment decisions for both producers and consumers.

Risk and transition

The ongoing energy crisis in Europe has increased the risks in the entire energy system. The vulnerability of being dependent on (Russian) fossil energy means that the risk in the transition to renewable energy sources has become relatively lower compared to the risk of remaining in the current energy system.