Weather change in October

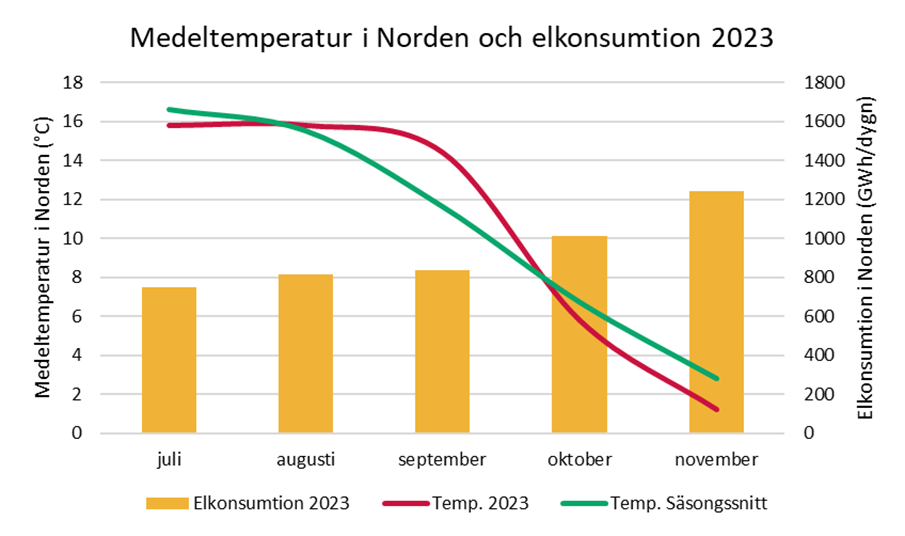

The mild and rainy weather that has dominated since July turned cold and dry in October. The average temperature in the Nordic Region was 9 degrees Celsius lower in October than in September, a bigger drop than the seasonal 5 degrees. The lower temperatures increased the heating load, which increased electricity consumption by 21 per cent.

Figure 1: Weather change. With October came autumn: The average Nordic temperature fell by 9 degrees between September and October 2023 and electricity consumption rose by 21%. In addition, precipitation decreased

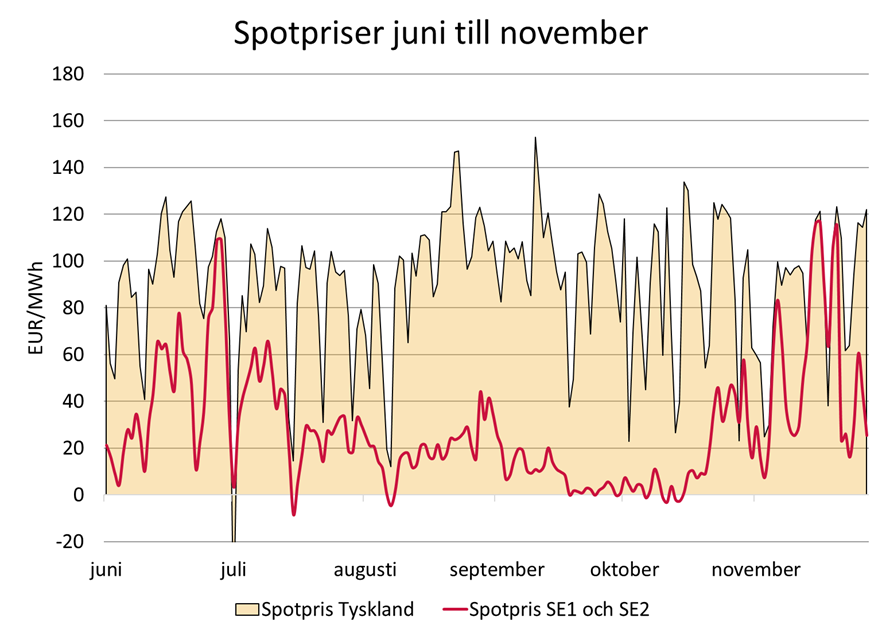

As well as getting colder, the weather also got drier. This had two important effects on Nordic hydropower: production in hydropower plants without reservoirs fell and inflows to hydropower plants with reservoirs decreased. Combined with the increase in consumption, this resulted in hydropower producers regaining price control over water volumes, setting the water value in their spot bids and optimising power generation towards higher prices on the forward curve. In northern Sweden, electricity prices rose from the range of -3 to 12 öre/kWh in early October to 134 öre/kWh on 16 November.

Figur 2: From forced production to volume control. As hydropower producers regained control over water volumes, the spot price rose rapidly from below 12 öre/kWh to a peak of 134 öre/kWh in less than a month, an increase by a factor of eleven. During the price peaks in SE1 and SE2, the electricity price areas linked up with the German market.

Marginal pricing prevails

As in most other markets, the price of electricity is set by the last unit of demand and production. In Europe, the marginal pricing power sources are usually gas power and coal power, which have also risen sharply in recent years. This is the electricity price that Nordic hydropower producers prefer to sell their volumes at, and they would have received it if the transmission grid had been sufficient to equalise prices between the electricity price areas and resulted in price coupling. Price coupling occurs when the generation surplus in one electricity price area is lower than the available transmission capacity to another. However, if the capacity is insufficient or the generation surplus is too large, the electricity price in the electricity price areas is determined separately and the surplus is locked in (price decoupling).

The value of water is determined by the market

The output of hydropower plants is optimised according to the size of the turbine, the amount of water in the reservoir, the expected inflow and taking into account any other hydropower plants upstream or downstream. Production planning can be divided into three perspectives: long-term, current season and short-term.

Long-term production planning is about extracting as much value as possible over time periods of up to two years, where the hydropower plant is modelled together with detailed forecasts of temperature, precipitation and electricity prices. The size of the reservoir is a limiting factor.

Medium-term production planning is the planning of the current season. It is based on reservoir levels, inflow rates, expected electricity prices and weather forecasts. The aim is to optimise the hydropower plant's operating schedule. Forecast uncertainty decreases as the delivery date approaches.

The short-term production planning is done for the coming days up to one week ahead. The run schedule is hourly to maximise the value of the volumes allocated to the period in the medium-term production plan. If the hydropower plant can save volumes for times with higher electricity prices, the water is also valued higher for the current period. Production is mainly optimised against the spot market, but also some of SvK's support service markets.

Forced production or price control

Hydropower producers want to get the best possible price for their volumes. Today, this is the price set by coal and gas power abroad. However, when the surplus in production is too large and the transmission grid is not sufficient, the volumes are shut down and the electricity price falls rapidly towards the input cost to the grid of around €1/MWh. If the price falls even lower, the hydropower producer prefers to spill water volumes past the power plant. This usually occurs during periods of persistently wet, windy and mild weather with high inflows, good wind power production and low consumption.

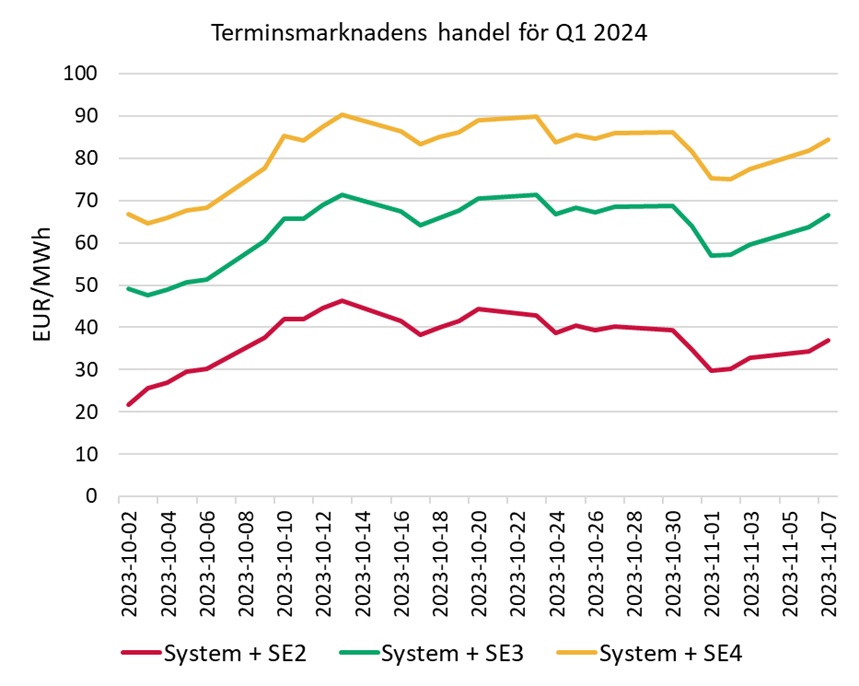

However, during weather changes such as in October, price control over volumes is quickly regained, the value of water increases and hydropower producers adjust their bids upwards on the spot and forward markets. The subsequent price increase comes as a surprise to many, which is why European marginal pricing is so important.

Figur 3: Futures market trading for Q1 2024 since early October. As forecasts for drier and colder weather arrived, expectations for the system price for the next quarter increased.

The situation now and in the future

The confined power surplus in northern Sweden often exceeds the capacity of the transmission grid to the south. This has long resulted in the lowest electricity prices in the entire EU, but those days should soon be over, because nothing stimulates consumption as much as a low price. And we have plenty of electrification plans in the north. Growth in power consumption is now outpacing the commissioning of new power generation, and the declining power surplus means fewer hours of trapped power. This will result in more and more hours with price coupling to neighbouring and higher-priced electricity price areas, which will already happen in the next two to three years. According to economic theory, this means that total welfare will increase, but for hydropower producers and electricity consumers in northern Sweden it may come as a surprise when Sweden becomes part of Europe in terms of electricity prices.