The day-before advert, an outdated method

Producers, electricity traders and consumers currently feel that the spot price of electricity is outdated. The settlement of production, contracts and consumption against the day-ahead market (the spot price of electricity) does not reflect the reality in which we already find ourselves and risks being even less suitable in the future. Spot pricing is designed to allow operators to bid during office hours and then go home, something many operators have already stopped doing in favour of round-the-clock monitoring. Already today, the dysfunctionality of the spot price creates misallocation of capital, unnecessarily high electricity costs for entire countries and regions, magnifies asymmetric risks and delays electrification. This analysis paper provides an example of the problem and some ideas that could result in both short-term and long-term welfare gains.

Record consumption and record prices - the price peak in Finland January 5th

At the beginning of January, the winter cold tightened its grip on Finland and the heat load increased. By Friday 5 January, consumption was estimated to reach 15 GWh/h, a new record. At 09:13 on 4 January, the transmission system operator Fingrid called on the country to save electricity. The call was widely publicised. At lunchtime on 4 January, Nord Pool's algorithm set the spot price for the next day, and indeed the forecast record consumption resulted in a record price: SEK 10/kWh on average and a price peak of SEK 21/kWh hour 18-19. This is significantly higher than the prices for the similarly cold 4th of January with an average price of 2.55 kr/kWh.

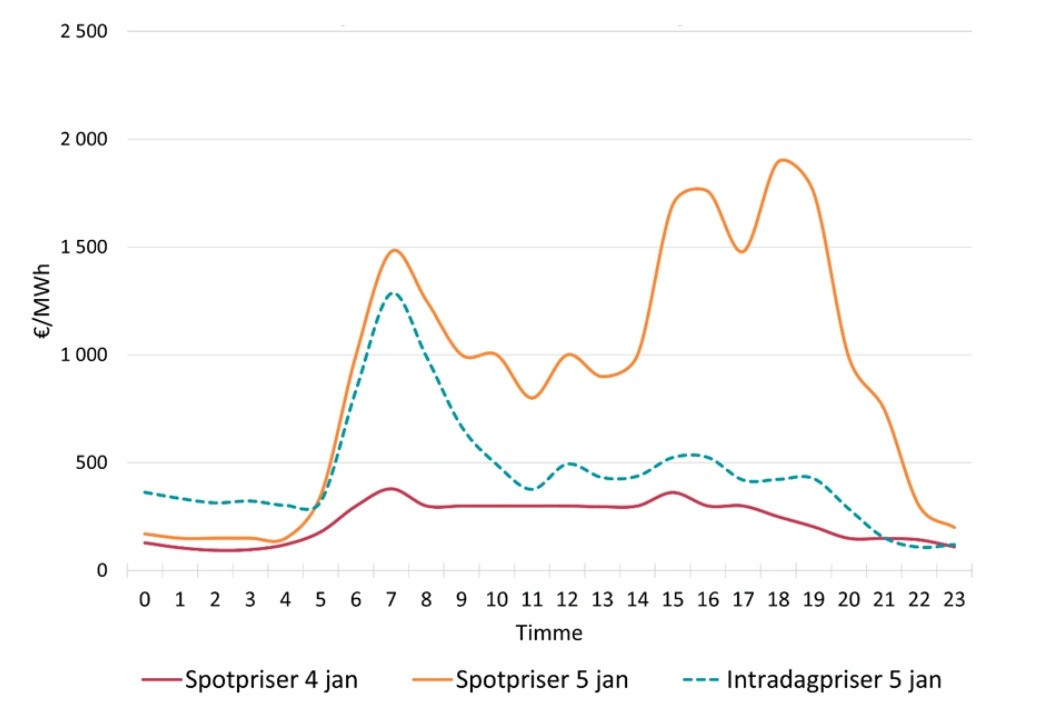

Electricity prices in Finland on January 4th and 5th

Caption: Electricity prices in Finland: Spot (day-ahead) prices for 4 and 5 January (red and amber) and intraday prices for 5 January (dashed). Thanks to consumers reducing their energy consumption, the intraday price was significantly lower than the spot price on 5 January. However, for Finnish consumers it was already too late. Source: Sigholm, Nordpool

Finns break consumption record

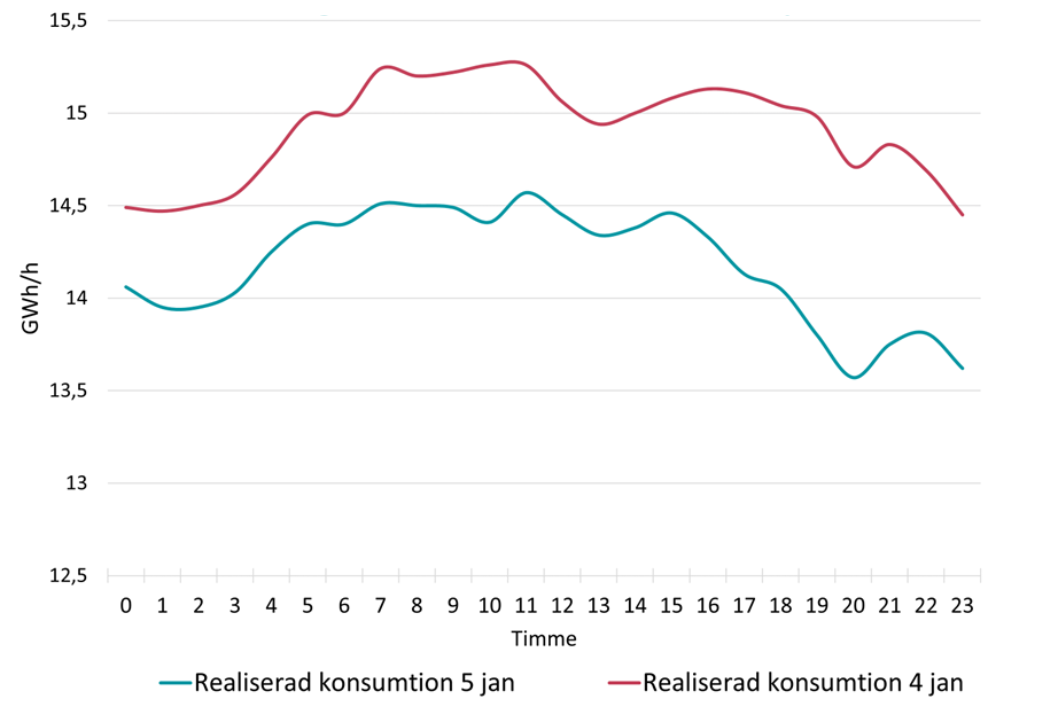

But in the 5 January delivery, record consumption fails to materialise. It turns out that Fingrid's warnings have been heeded and already in the morning hours consumption comes in 800 MWh/h lower than feared. All in all, consumers are saving around 6% and the average consumption on 5 January was not 15 GWh/h but a more modest 14.17 GWh/h. This is also significantly lower than on 4 January, when consumption averaged 14.45 GWh/h. Since wind and nuclear power production was roughly the same on both days, it is not unreasonable to assume that the electricity price could have been lower on 5 January than on 4 January, if actual consumption had been used instead of the forecast.

Real consumption in Finland January 4th and 5th

Caption: Realised consumption in Finland: Finns heeded Fingrid's warnings and reduced consumption significantly despite the winter cold, especially hours 18-19. All else being equal, the lower consumption on 5 January should have resulted in a lower electricity price than on 4 January. This was not the case as the electricity price is set on forecast 18-36 hours before delivery. Source: Sigholm, Volue Insight

Crisis prices but no crisis

As the spot price of electricity is set 18-36 hours before delivery, the efforts of Finnish consumers did not affect the price, even though the actual price of electricity was likely to be significantly lower than the spot price of SEK 10/kWh that consumers were now paying. The fact that the crisis was averted but the crisis prices persisted caused a lot of surprise and lively discussions in various forums, as reported by Helsingin Sanomat, among others. And it's a good question - why should consumers adjust their consumption when the price they have to pay is already set? In intraday trading, which lasts until the hour of delivery, the price averaged SEK 5/kWh on 5 January, half as high as the spot price. And there was no price peak in hours 18-19: the intraday price in the same system and for the same hour was just over a fifth of the spot price.

Spot price needs to be redone, sooner rather than later

The sequence of events offers several insights. With a growing share of intermittent generation from solar and wind power, the latest weather forecasts before the hour of delivery will have an increasing impact on the actual price of electricity. There is also a rapidly growing interest among households and businesses to be flexible and thereby reduce their electricity and power costs. Two issues are central:

- What application of strategies and electricity trading products under current conditions would result in a more accurate electricity price?

- How should the spot market function in the future, if it were to be adapted to better reflect the real price of electricity?

To answer the first question: there is much that could be done in the existing system. The high prices were due to the fact that the consumption forecasts sent to the spot market were too high and did not include consumer behaviour given high electricity prices and Fingrid's calls. A more dynamically structured forecast with different price conditions could have made a bigger difference than it did, and more of the 6% reduction in consumption might have been included. But such a structure requires a much greater knowledge of consumer behaviour. This, in turn, requires both more accurate data collection and much more customer interaction. For example, how many customers say they have the option to change their behaviour, how big is that change and at what prices does what flexibility apply? Can the flexibility be empirically proven through data analysis? Can forecasting be improved by moving from passive to active customer interaction at the time of forecasting? If so, what digital interfaces, electricity trading products and type of customer communication are needed? And what is allowed by law, for example if customers want more settlement against intraday trading in their electricity price?

The second issue requires much bigger systemic changes. If the root problem is that the spot price is set too far away from the delivery hour, the solution would be to move the bidding closer to delivery. Instead of one session 18-36 hours before, perhaps the spot bidding should be split into four sessions with bidding for 6 hours at a time and every six hours. This would give both large and small buyers and sellers access to trade closer to the hour of operation. Consumers would have better tools and more power to directly influence their electricity costs. For renewable power producers, a more realistic spot market would significantly reduce price and volume risks, which would likely accelerate the deployment of renewables. A fairer settlement would also favour the trading of bilateral and forward contracts, as the inherent profile risks would be greatly reduced. Overall, this would increase welfare gains in society.