Long-term forecast updated

Sigholm Tech continuously quantifies and analyses the major changes taking place in Europe's energy system. In our recent long-term forecast, we have weighed up several different aspects and simulate the electricity price for the years 2023-2050 per Swedish electricity price area and per power type. The content describes the development of the global energy markets and the impact on European, Nordic and Swedish power pricing. Each of the different price drivers is presented separately.

The December forecast also includes an in-depth look at China's energy use and its impact on global fuel markets, the future availability of more liquid fossil gas and an expanded discussion of wind and solar power profiles. Below is a selection of the conclusions that emerged during the work.

High supply uncertainty

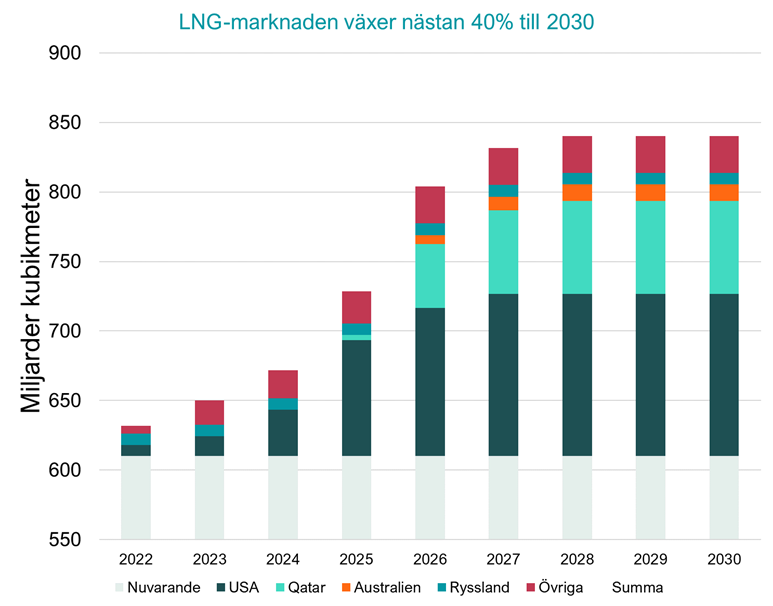

The energy crisis continues to be mitigated by record mild temperatures even this year. The withdrawal season from European gas stocks did not start until 20 November instead of mid-October. But the loss of Russian energy imports has long-term consequences, especially for the supply of fossil gas. Russian gas accounted for 40 per cent of the EU's total imports before the war. Combined with declining domestic production, Europe needs to shift its import source from traditionally predictable pipeline supplies from Russia to liquid, ship-borne fossil gas. This means a shift from long-term contracts in a regional market to spot purchases in global competition. Europe is therefore likely to continue to pay a higher price than before to meet its needs. The supply of liquid fossil gas is occasionally tight, but the situation is expected to gradually improve as new export capacity comes on stream.

Figure 1: Commissioning of LNG production capacity will increase in the coming years. But both Asia and Europe want the supplies. We outline how much of Europe's needs can be met by volumes agreed so far, and how much of the supply is still uncertain.

Risks

In the fuel life of waste and biomass, the supply disruption in energy markets combined with the lack of transparent markets, lax risk management and a rigid pricing structure to downstream customers has drastically increased the risks in power and heat operations in a way that has still not sunk in with many of the industry's playe rs.

Load is rising rapidly

Demand for electricity is predicted to rise in both the Nordic region and Sweden. The year 2026 is expected to be the first year since 1985 that electricity demand in Sweden is structurally increasing. The electrification of existing operations and new industrial establishments should result in demand increasing faster than the commissioning of new power generation. The once prolific Nordic power surplus will therefore shrink rapidly. As a consequence, the electricity price discount enjoyed by consumers in several Nordic price areas compared to other European areas will rapidly disappear in a way that will surprise many actors, especially in northern Sweden. At the end of the forecast period, a deficit in the power balance is formed that threatens the electrification of new and existing industrial activities. It is likely to be a bumpy ride.

Robust carbon prices

The carbon pricing reforms of recent years have created strong momentum. The EU's Fit for 55 reforms will be implemented next year. The continued tightening and expansion of the EU Emissions Trading System (EU ETS) has increased carbon prices by a factor of 17, from €6/tonne in 2017 to reach €100/tonne of carbon for the first time on 20 February this year. The sharp rise represents a 75 cent/kWh premium on the marginal cost of generating coal power and 31 cent/kWh for gas-fired power plants. This year, the price has averaged €85/tonne, which is a much smaller decline than in other commodities. The current carbon price is likely to be too low to meet climate targets.

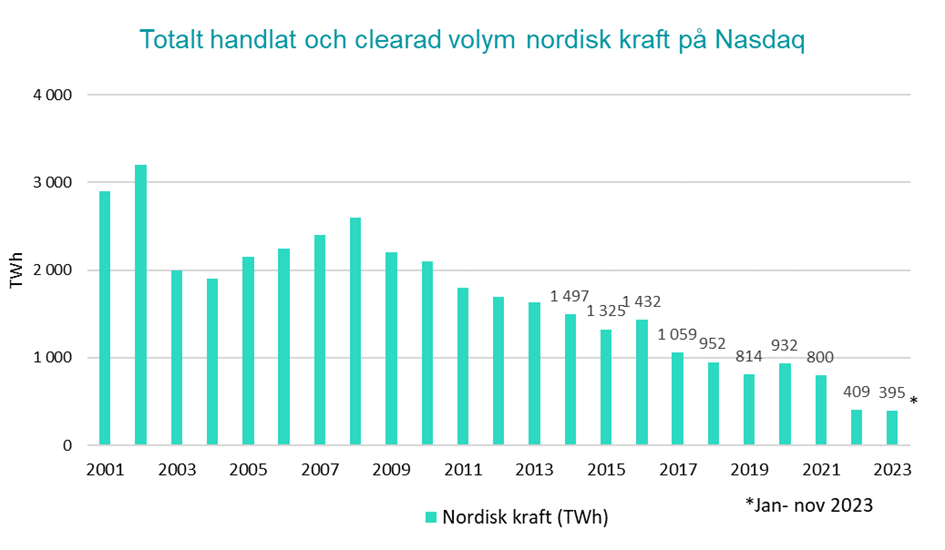

Market liquidity continues to fall

Market liquidity on the Nasdaq futures market continues to fall. In January to November 2023, only 391 TWh of Nordic power was traded and cleared on Nasdaq. The loss of liquidity dilutes the function of the futures market as a reference of buyers' and sellers' expectations of the electricity price in future delivery. The usefulness of the price curve in investment decisions, hedging strategies and budgeting is thus also diluted.

Figure 2: Futures market trading on Nasdaq since 2001. The loss of liquidity reduces the role of the futures market as a reference for buyers' and sellers' expectations of the price of electricity in future delivery.

Risk and transition

Since the risks in the current energy system have risen drastically since 2021, exposing major supply uncertainties, a transition away from a fossil-based energy system is relatively less risky than before. But much remains to be done in both the power and heat business, because customers want secure deliveries, low emission costs and predictable prices. The higher interest rates place higher demands on capital-intensive projects, which in turn increases the likelihood that we will see more international policy initiatives.