At the peak of energy prices in 2022, our elected legislators were looking for tools to absorb the impact of the price shock on society. Contracts for Difference (CfD) emerged as a possible solution and has been part of the debate ever since. The tool itself is not new, but has been used for a long time in Europe to support the construction of new wind and nuclear power plants. In the ongoing discussions, there are many interpretations of what CfD is supposed to do. Sometimes the acronym appears as a panacea, a solution to almost everything.

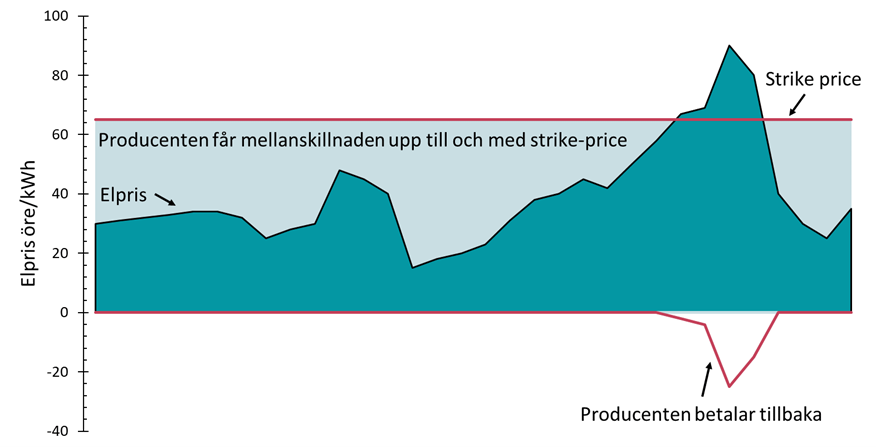

Example of Contract for Difference - If the price of electricity is below the strike price, the government pays the difference to the generator. If the price is above the strike price, the producer pays back the excess revenue to the government.

Source: Sigholm, House Of Commons Library

Theoretical aspects

There are several economic aspects that help to understand the impact of different interventions on a market and where the perceived need for CfD comes from.

Marginal cost pricing in the electricity market

The electricity market is an energy-only market with marginal pricing. Electricity producers are paid for the energy they produce, supply is defined by the merit order and demand by traditionally inelastic electricity consumption. In the electricity market bidding, fixed costs are excluded because they are sunk costs, money already spent that cannot be recovered regardless of whether the decision is to produce or not. In the electricity market, generators are also not paid for the power, rotational energy or other potential benefits they bring to the electricity system.

The electricity network in Sweden is defined as a monopoly. In theory, this means that the electricity market must eventually be supplemented with investment grants or risk sharing for any new production and various subsidies for the capacities that are added to the system in addition to energy. Through support service markets, some producers are paid for the benefits they deliver to the electricity network monopolies.

Subsidies change the allocation of capital

In any market, the introduction of a subsidy implies a change in the allocation of capital. If all production in a market is subsidized, then, other things being equal, there is systematic oversupply. In theory, subsidizing one type of output over others means that this type of output crowds out other types of output to a greater extent than would otherwise be the case. As with all interventions, subsidies increase the overall political risk, as one intervention increases the likelihood of further interventions.

The system cost

Theoretically, the system cost of producing electricity in the electricity market can be considered given. The order of merit is determined by which power plants are physically available and the price of the various fuels, with gas, emission allowances and coal being the most important. The price is also relatively influenced by weather, water and wind. Demand is determined by industrial and household consumption, with electrification rates, economic cycles and outdoor temperatures being important price drivers. The price of electricity is thus anchored in different real-world conditions. How the bill is paid, however, is not.

During the energy crisis, over a 12-month period, EU countries spent more money on energy subsidies (around €800 billion) than on education (around €700 billion in 2021). Most of the subsidies were unconditional or had no specific purpose, other than paying for energy costs from public funds instead of electricity and gas bills.

Although large subsidies make consumers' bills appear lower, most consumers are also taxpayers. There are strong arguments to support efforts to help particularly vulnerable households, but this presupposes that crisis subsidies are designed to take into account the degree of vulnerability of households. This was not the design of most crisis support, including the Swedish electricity price support.

Diversified expectations for CfD

We have identified three different expectations of what the CfD should do. It is easy to wish for a CfD design with several built-in functions, but such combinations risk making the tool too blunt to fulfill its main intended purpose.

CfD as a contribution to new production

The energy-only market provides compensation for variable but not fixed costs. Over time, therefore, new investments in power generation should be lower than needed. Theoretically, therefore, some type of support scheme must be in place, such as electricity certificates, direct subsidies or risk-sharing arrangements. In Europe, CfD is likely to remain an important instrument for financing new power generation, a fact that the Nordic countries also need to take into account.

Another support system for new generation that has been used successfully in Sweden is the electricity certificate system, which closed in December 2021 when the system's expansion target for 2030 was already heavily overextended. As a result of the over-development, the price of electricity certificates dropped like a stone, especially when the market ran out of steam in 2017. An unfortunate consequence was that many early and small investors ran into difficulties in what came to be known as the 'green bloodbath'. But for taxpayers and electricity consumers, the scheme was affordable and exceeded its targets.

CfD as electricity price support

In a changing reality, market prices change. Poorly informed and unlucky customers suffer from volatility, especially when prices are high. Regulators may therefore want to try to absorb the effects through public funds, thus mitigating the symptoms. But this does not reduce the underlying volatility. The system cost just ends up on the tax bill instead of the electricity bill. On the contrary, it may exacerbate the situation and ultimately worsen the crisis because the right price signals are no longer reaching the relevant actors, who should ultimately be in the best position to take action. Thus, volatility can be seen in two ways: as a symptom of an underlying disease that needs to be treated, or the probably more pragmatic and sustainable view that volatility is a natural market signal to market participants about how they should act and what capabilities are needed.

CfD as a financial instrument

It could be possible to trade and hedge exposures with CfDs. However, as existing CfDs are often specially adapted tools, this risks missing the very point of futures contracts, which is that they are standardized and can therefore be easily bought and sold between different participants. CfDs today are often some kind of targeted, bilateral support systems. The introduction of more trading of CfDs may therefore not contribute to the liquidity of the futures market, but may on the contrary worsen it.

Misallocated capital and misplaced ambition?

What is most worrying about the desire to cure the symptoms and cloud price signals is that it also clouds the incentives to act appropriately or invest in what is most in demand. In turn, this increases the risk of disorderly capital flows and misallocation of capital. The good intention of protecting against volatility thus risks effectively disarming consumers in the long run, who in practice lose the power to improve their own situations. And the question is whether CfD as electricity price support is still relevant with the lower energy prices this spring. As the memory of the price peaks of 2022 fades, so does the momentum behind the introduction of new support schemes.

Instead, a discussion on how the tools and risk management principles already in place can be used more effectively would have been welcome. Or to conclude with a quote from the Swedish Energy Markets Inspectorate from the Energiforsk seminar on April 9: “How much market we should have is a political decision. We will make sure that the market that is left is well functioning”.

What we offer:

Sigholm performs analyses, long-term forecasts and clarifies insights that are essential in your organization's navigation in the system transition. The world is changing and through lectures, workshops and longer assignments, we help our customers acquire the skills needed to succeed. If you would like more information about our services, please contact us using the contact details on this page.